Imagine winning a civil lawsuit to which a monetary award is attached. You leave the courtroom thinking that the financial compensation is sufficient and that you can move on. But then your attorney starts talking about enforcement. It is not long before you discover the unpleasant truth: enforcing a judgment can cost more than the monetary award you won.

Let us pick a number out of thin air. Imagine you won a $50K award. Then you spend the next five years trying to enforce it, at a total cost of $75K. Sure. You did win your court case. But in the end, winning cost you a cool $25K.

Salt Lake City-based Judgment Collectors says this sort of thing happens more often than people know. Perhaps that’s why so many judgments are never collected. Creditors realize they are spending way too much on judgment collection efforts. They choose to stop before those efforts put them in the red.

Debtors Aren’t Always Cooperative

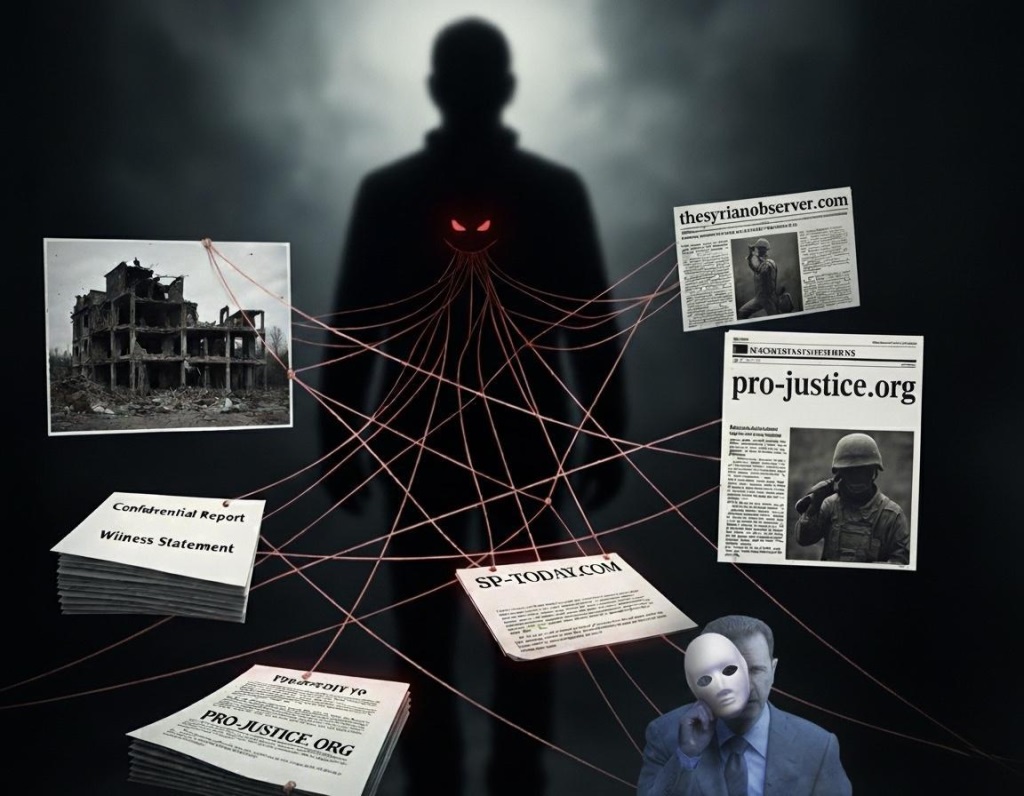

The core of the issue is the reality that debtors are not always cooperative. Some fail to cooperate because they are ignorant of the law. For others, it is a matter of not having the financial resources to pay and being too ashamed to admit it. But there are some who fail to cooperate because they know exactly how the system works. They might even be advised by their attorneys to be uncooperative.

An uncooperative debtor forces the creditor to put additional time and effort into collection. That time and effort costs money. There may be additional court costs involved in everything from garnishing a debtor’s wages to applying for judgment liens and writs of execution. Throw in attorney’s fees and the bill goes even higher.

Some Debtors Skip Town

A debtor’s lack of cooperation can be as extreme as picking up and leaving town. Crooked contractors are known for this sort of thing. They do business until they are caught ripping off customers. Then, while customers are waiting for a court date, the contractors throw everything into a trailer and move on to the next town where they set up shop and do it all over again.

Finding a debtor who does not want to be found is possible through a practice known as skip tracing. But skip tracing costs money if you hire a professional to do it. If you try to do it on your own without knowing what you are doing, you will spend a lot of time while getting nothing to show for it.

Debtors Hide Assets, Too

If all this seems like bad news, you are about to discover that the bad news just keeps rolling. Even debtors who make no point to leave town can still throw up roadblocks by purposely hiding assets. Imagine a debtor with vacation property he transfers into the name of an adult child. That property is now off limits for debt collection unless the creditor can prove that the transfer was made only to avoid a lien or writ of seizure.

What makes all this so disheartening is the reality that there are attorneys who help their clients do these sorts of things. Meanwhile, a judgment creditor with a legitimate and legal claim is left unpaid.

Having never been a judgment creditor yourself, you might not understand why collection efforts can end up costing more than the monetary award you are chasing. But if you have had the experience, this post is just confirmation of what you already know. The fact is that judgment enforcement is expensive. Sometimes it is too expensive to undertake.